In 2021, countries have still not fully emerged from the epidemic. The global economy has experienced another extraordinary year.

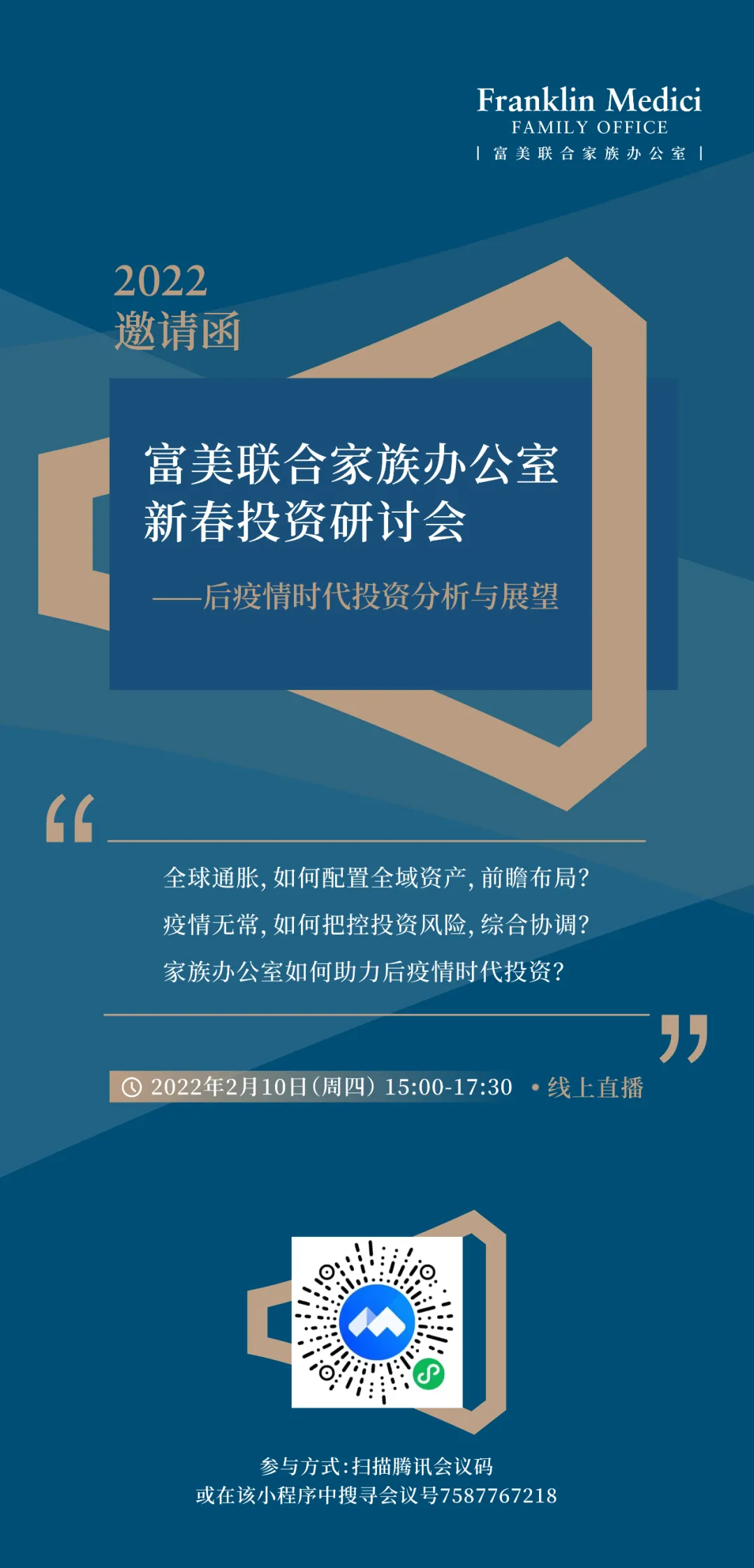

Global inflation, how to allocate the whole region assets, forward-looking layout? How to control investment risks and coordinate comprehensively in the midst of an epidemic? How can a family office facilitate investment in the post epidemic era?

You are cordially invited to take the time to——

Franklin Medici Family Office 2022 Chinese New Year Investment Seminar

Thursday, February 10, 2022 15:00-17:30

Live Webcast

Former Deputy Director General of Singapore Economic Development Board (EDB) was invited by Franklin M edici Family Office to analyze the Singapore government's investment policy and immigration (permanent resident application) policy. There were also heavy hitters from renowned organizations such as Singapore Exchange, JP Morgan Investment Bank, Credit Suisse, National University of Singapore, IPPFA, Goodwater Family Office, Wellington Asset Management,etc. to share their views on the following topics of market concern:

Looking back at the capital markets in 2021

Understand the past to better understand the future. Ms. Gwenn Khoo will take a look back at 2021 to put her finger on the pulse of the market and stay close to the current market.

Ms. Gwenn Khoo is a former Vice President of United Overseas Bank and has over 10 years of experience in portfolio management for high net worth individuals. With her rich experience in different fields such as banking and securities, Ms. Gwenn Khoo has a multi-dimensional perspective on the market and will provide you with an understanding of the trends from different perspectives.

Global assets through Singapore

As Asia's wealth management center, Singapore attracts talent and wealth from around the world. Over the past decade, more and more domestic HNWIs have also begun to choose Singapore as one of the key wealth pooling locations. The government has also introduced multiple policies, especially the family office policy, in the hope of promoting the development of wealth management at the policy level and attracting more HNWIs and their families to lay out their global assets through Singapore. Therefore, we are honored to invite Mr. Chua Taik Him, former Deputy Director General of the Economic Development Board (EDB) of Singapore, to share with us the Singapore government's investment policy and immigration (permanent resident application) policy. Mr. Chua was the former Director General of Singapore's International Enterprise Development Agency, Economic Counselor of the Singapore Embassy in Tokyo, and Advisor to the World Bank's Industrial Structure Strategy Committee, and has deep and unique insights into economic policies.

JPMorgan Chase 2022 Market Analysis

Following the market outlook and policy analysis, Ms. Judy Zhu, Executive Director of JPMorgan Private Bank, will analyze the market trends in 2022, and help investors stand on the shoulders of giants and look into the treacherous capital market with her excellent investment research capabilities.

Private Placement Investment Analysis

Moving from megatrends to niche areas, Mr. Alex Ma, CIO, Chief Investment Officer of Goodwater Family Office, will bring us insights into the private equity investment space. He has been in the private investment field for many years, and has been the head of investment of the single family office of the richest Chinese in the UK, an executive committee member of the SIG of Fund Research of the Chartered Institute of Financial Analysts (CIFA), and a guest lecturer at the University of Oxford & the London School of Economics and Political Science.

Special Purpose Acquisition Company (SPAC)

The SPAC investment boom has attracted a lot of attention in the past few years. We have invited Ms. Chia Caihan, Chief Representative of SGX Beijing Representative Office, to discuss the investment characteristics of SPAC from the Exchange's perspective. Ms. Caihan was formerlythe Special Assistant to the Chief Executive Officer of the Singapore Exchange, and joined the Listing Committee and Compliance Committee of the Singapore Exchange, where she was involved in the approval of IPO applications and major compliance matters for listed companies. Ms. Tse has 10 years of regulatory experience in the Listing Review and Supervision Department of SGX, having reviewed over 1,000 listing and refinancing applications for securities and debt securities.

Analysis of protection assets

As an indispensable part of the investment portfolio, protection assets play a heavyweight role. Franklin Medici also invited Mr. Wee Tiong Howe, the recognized leader in financial planning in Southeast Asia, to give a professional analysis. Mr. Wee Tiong Howe has been in the financial planning and insurance industry for more than 40 years and has achieved market recognition in many countries and regions. He was the Chairman of the Life Underwriters Association of Singapore (LUA, now IFPAS), the founding Chairman of the Singapore Association of Financial Services Professionals, and led the establishment of the Asia Pacific Life Insurance Council,today known as the Asia Pacific Financial Services Association (APFSA) - the largest conference of financial planning and insurance practitioners in the Asia Pacific region.

Structured investments in protected assets

Structured investments, as a type of protected assets, have received the favor and attention of many investors. Mr. Charles Firth, Managing Director of Credit Suisse Hong Kong, will explain the advantages of structured investments in order to better utilize this wealth management tool. Mr. Firth is responsible for managing Credit Suisse's structured products sales team in the Southeast Asian market, and has previously held senior positions at UBS and Barclays.

Global Real Estate Analysis

The New Crown Epidemic is not only affecting the global economy on a macro level, but is also gradually penetrating into our lives, causing drastic changes in real estate usage and demand.Mr. Lee Nai Jia Lee, Associate Director of the National University of Singapore's (NUS) Institute of Real Estate and Urban Studies (IRES), will share noteworthy megatrends in the next five years from a macro perspective, so as to understand where different properties are heading in different regions. As a PhD in Urban and Regional Planning from the Massachusetts Institute of Technology, Mr. Lee will bring a collegiate perspective to the table.

Metaverse

With Facebook officially changing its name to Metaverse, more and more eyes are focusing on Metaverse as an investment sector. Mr. Jung Soo Ho, an analyst from Wellington Asset Management, will share his ten years of experience in technology and consumer sectors, and the key points of investing in the Metaverse concept.

Digital Asset Analysis

Beyond the metaverse, digital assets are also on the rise. With a large number of artists and investors coming into the market, how should we respond to this investment boom? Mr. Li Zhongqiang, the founding partner of Dragon Roark, will give us an analysis of digital assets, and look forward to the new forms and trends of investment. Mr. Li has more than 20 years of experience in venture capital and business incubation, worked in Shanghai Jiaotong University Industry Group, and participated in more than 20 investment projects, including multiple blockchain investments and successful exit cases in both domestic and overseas capital markets. Looking back to 2021 and looking forward to 2022, we invite you to join us at Franklin Medici.